It’s nearing that time of the year again where your end of financial year tax-deductible donation can help us support the 235,000 young carers providing care for a family member living with a disability or chronic illness in Australia.

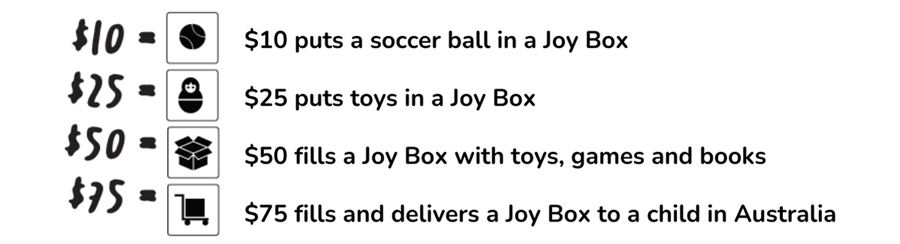

We are aiming to raise $5,000 to help fill our young carer Joy Boxes with toys, school stationery, books and sports equipment.

With your help, we can reach our goal and pack Joy Boxes full of fun, play and childhood experiences for young carers.

Benefit of making a EOFY donation

Making a big donation at End of Financial Year (EOFY) is not only good for the soul; it is also good for your bank balance. Donations can reduce taxable income.

How do I claim a tax deduction?

- Make a donation to CaringKids and keep the receipt.

- Gather all of your tax documentation including tax file number, PAYG payment summary and receipts.

- Lodge your tax return online, with a paper tax return or with a tax agent.

- Pay close attention to section D9 Gifts or donations of the return – this is where you should record your donations.

If you are in a position to help children who take on adult responsibilities caring for a parent or sibling, every dollar counts.